According to Analysts, This Tech Stock Has the ‘Longest Runway.’ Should You Buy It Here?

/Spotify%20logo%20by%20Bastian%20Riccardi%20via%20Unsplash.jpg)

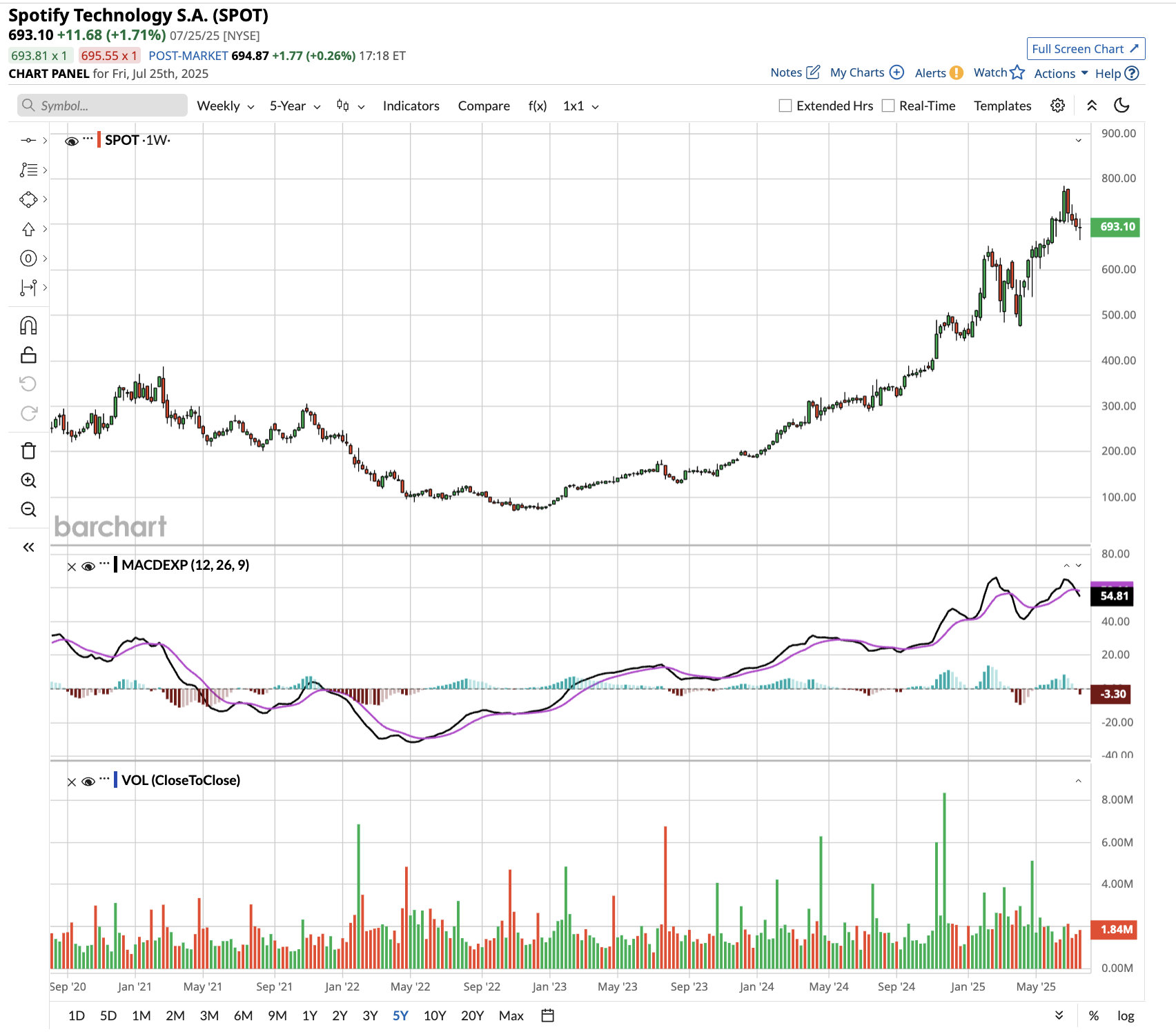

Spotify (SPOT) stock gained close to 2% on Thursday, July 24 after Oppenheimer upgraded the streaming giant to “Outperform” with an $800 price target, arguing the company has “the longest runway” among large-cap internet stocks despite trading 12% below all-time highs.

The firm forecasts that Spotify stock will add approximately 75 million net new users annually from 2026 to 2030, yet still reach only 17% of the global adult population by the end of the decade, significantly lower penetration than peers like Meta (META) and YouTube, suggesting that substantial growth potential remains untapped.

Oppenheimer identifies several catalysts driving the bullish outlook. The company’s under-monetized free tier presents a massive opportunity, with analysts projecting €10 billion in potential advertising revenue by 2030 if Spotify closes the gap with traditional radio and podcast advertising rates. Alternatively, introducing a modest €1 monthly fee for the lowest tier could generate up to €12 billion in revenue.

Recent App Store changes are expected to improve paid user conversion on iOS, while the upcoming “Superfan” tier launch and successful price increases, supported by low churn rates, are expected to provide additional revenue drivers. The firm expects gross margins to expand from approximately 31% currently to 37% by 2030, driven by the profitability of podcasts and effective cost control measures.

The $800 price target reflects 20 times Oppenheimer’s 2030 earnings estimate, factoring in €20 billion in projected share buybacks while maintaining €17 billion in cash reserves, underscoring confidence in Spotify’s long-term financial trajectory.

Spotify Continues to Grow at a Steady Pace

Spotify reported its second-highest first quarter for premium subscriber additions ever, reaching 268 million net subscribers, surpassing expectations and marking the strongest Q1 performance since 2020. The music streaming giant’s monthly active users grew to 678 million, while total revenue climbed 15% year-over-year to €4.2 billion on a constant currency basis.

CEO Daniel Ek expressed optimism about the business fundamentals despite broader macro uncertainty, noting that engagement remains high and retention is strong. Spotify’s freemium model provides flexibility for users during uncertain times. This tier contributed to the robust subscriber growth, which was driven primarily by emerging markets, particularly Latin America and the Asia Pacific.

Premium revenue increased 16% year-over-year, driven by continued subscriber growth and higher average revenue per user resulting from recent price increases. The advertising business exceeded expectations, achieving 5% growth, thanks to automated features that attracted over 10,000 advertisers, representing a 21% year-over-year increase.

Spotify’s gross margin expanded to 31.6%, surpassing guidance and improving 400 basis points year-over-year. Operating income reached €509 million, while free cash flow hit €534 million for the quarter. The company ended with €8 billion in cash and short-term investments.

Looking ahead, management forecasts 689 million MAUs and 273 million subscribers for Q2, with €4.3 billion in total revenue.

Is SPOT Stock Undervalued Right Now?

Analysts tracking SPOT stock estimate revenue to increase from $16.28 billion in 2024 to $33 billion in 2029. In this period, adjusted earnings are forecast to expand from $5.71 per share to $21.23 per share. Compared to the previous year, free cash flow is projected to increase from $2.37 billion to $7.58 billion. If SPOT stock is priced at 35 times forward FCF, it should trade at a market capitalization of $265 billion, indicating upside potential of 86% over the next three years.

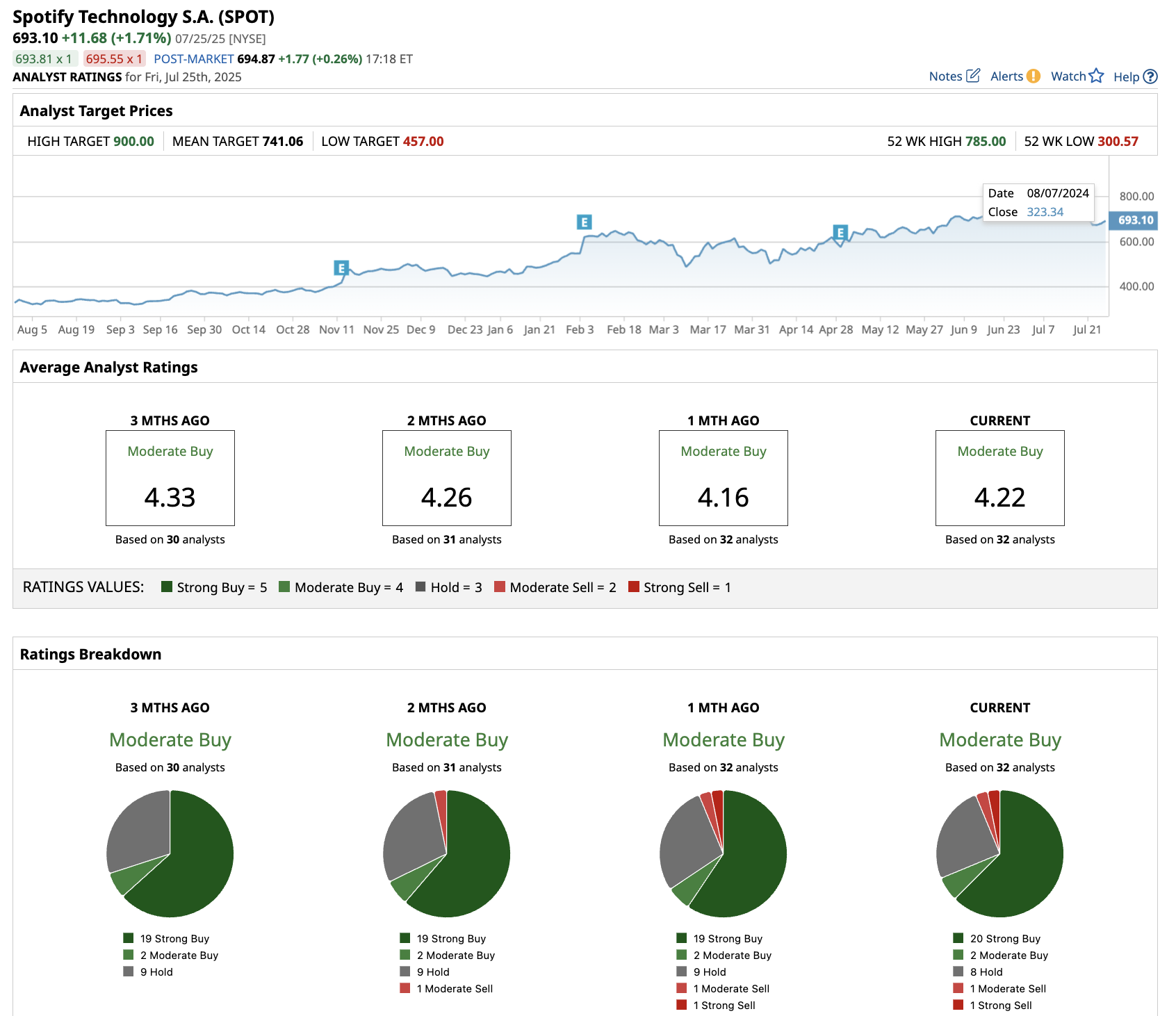

Out of the 32 analysts covering SPOT stock, 20 recommend “Strong Buy,” two recommend “Moderate Buy,” eight recommend “Hold,” one recommends “Moderate Sell,” and one recommends “Strong Sell.” The average target price for SPOT stock is $741, roughly 5.6% above the current price.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.